Who we are

Since 2013 Digithouse have helped numerous clients to escape from the tyranny of handling their everyday finance function by themselves. We’ve worked with many private companies, but our specialism has been working with charities and non-profits in the Third Sector.

After more than a decade working in the third sector we understand the importance of dissecting a charity and viewing it purely from a financial perspective. Once we understand the challenges we all face, we can move forward together to achieve the mission. The benefit of working with us is there isn’t much we haven’t seen.

Why the Third Sector?

We take great satisfaction from sharing our skills and expertise with values-driven organisations, and to see the real life impact of the numbers on the page. It is very rewarding to play a part in helping a charity make informed financial decisions that will enable them to continue their mission and make a positive difference to the lives of others. We also enjoy the challenge of working with organisations that often have limited resources and are trying to achieve a lot on a relatively small budget.

The connection with the people is also important to us. We’ve worked with some incredible organisations over the past 11 years and met some really inspiring people.

Bringing commercial experience into the Third Sector

The commercial and charity world rarely overlap. We believe they should and that a charity would benefit greatly from having a commercially focused finance professional as a member of their board of trustees. Where possible, such an appointee would be involved in the quarterly finance committee meetings. The internal finance worker who usually wears many hats in a charity could have a working relationship which allows open dialogue on all finance matters from reporting ideas to cash flow. Such a relationship should be encouraged by the CEO I order for better oversight between the day-to-day operations and regular updates to the treasurer. Digithouse provides such high-level finance management across many organisations where we work closely with you to develop robust processes to help you achieve your goals within budget.

It isn’t unusual for charities to be awash with cash in the form of reserves. Sometimes, a CEO may not understand the extent of those reserves or understand what is available to spend freely. We have experienced this many times. The first assessment we make when consulting is to fully understand the balance sheet and the funds available. We then discuss the near and longer dated plans for the organisation and assess the affordability of those plans. This is where we excel as we use methods from working commercially and then adopting these into the sector. We use financial planning tools such as Net Present Value using discounted cash flows to assess the profitability of future planned projects. Using such techniques can save a charity from closing down if such a project wasn’t priced correctly.

Power Bi Specialists

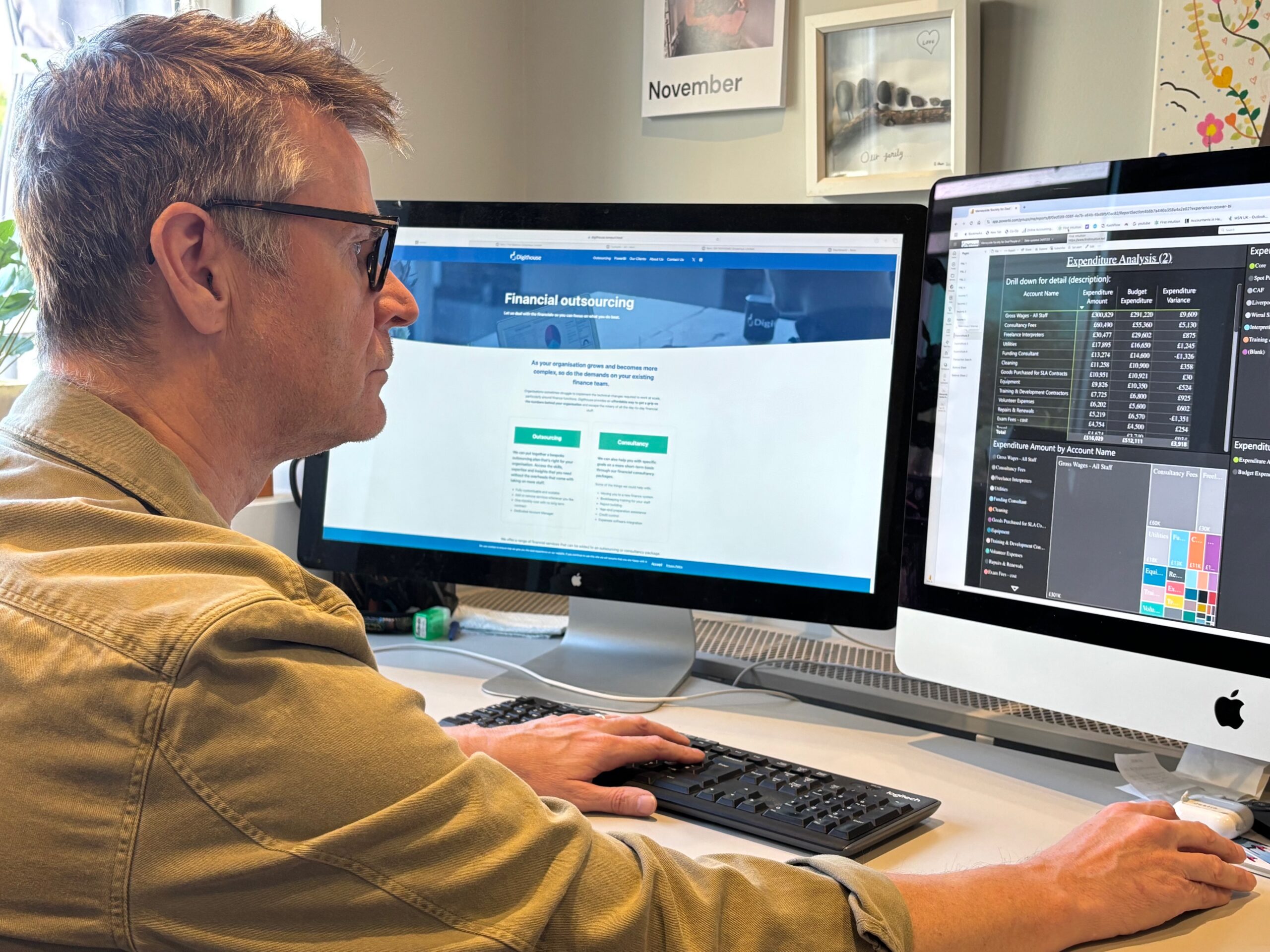

As part of our drive to bring private sector techniques to the Third Sector, we have been helping charities and non-profits to migrate their finance systems to Microsoft Power BI. This is a visualisation and analytics tool that brings together information from various sources into a sleek, easy to interpret dashboard. It enables organisations to review any aspect of their financials in real-time, allowing for accurate reporting and decision making informed by live data.

It has gained a significant userbase in the private sector as a way to manage financial information. However, high costs have limited exposure in the Third Sector.

We believe the Third Sector shouldn’t be prohibited from accessing the latest technologies because of cost, and we have created an affordable way for our sector to access this revolutionary tool.

The way we work

We have found that in most instances it is cost-effective for charities to outsource all or part of their financial function. By doing this they can access skills and expertise without the cost and bureaucracy of employing a large in-house team. For this reason we offer bespoke financial outsourcing plans as well as short term consultancy packages.

During an initial consultation we will work with you to find the level of service which is right for you. And if we don’t think this is the right approach for your organisation then we will tell you, and suggest an alternative solution.

You will be able to choose from a range of financial services (detailed here). There is no contract and you can add or take away services at any point. You will work with a dedicated account manager who will know the ins and outs of your financial setup and can answer any queries you might have.

Ready to simplify your finances?

Connect with us to discuss how we can support your goals.